Shelter is one of the most basic needs for any living thing. For more and more folks however, buying a home seems more like a pipe dream than a realistic goal. There is no doubt that there is a crisis around home ownership. Growing student loan debt, inflation, rising interest rates, and rapidly escalating prices, make buying and even renting seem impossible. Here is a brief look at some of the issues around affordability and some creative solutions that are addressing them.

Defining the Issue

First, people should understand that there is a difference between affordable housing and housing affordability.

Affordable housing is defined by the federal government. It is based on a percentage of the Area Median Income (AMI) as set by the Department of Housing and Urban Development (HUD) and is adjusted for family size.

For example, if you make less than 80% of AMI you would be considered Low Income. For a single person (a household of one) that is number is $76,750 in Alameda County[i]. For a family of four that number is $109,600. States can and do make minor adjustments, but the baseline is always the HUD data. Many affordable housing programs have a ceiling at 60% AMI for rental programs and 80% for home ownership programs.

Housing Affordability focuses on ensuring all income levels can afford housing. Sometimes people use the term affordable housing without realizing it would NOT apply to them. We are highlighting this because when we speak of solutions to our current housing crisis, we should make sure we are using the same definitions so that we are building solutions for all that need them.

The Problem

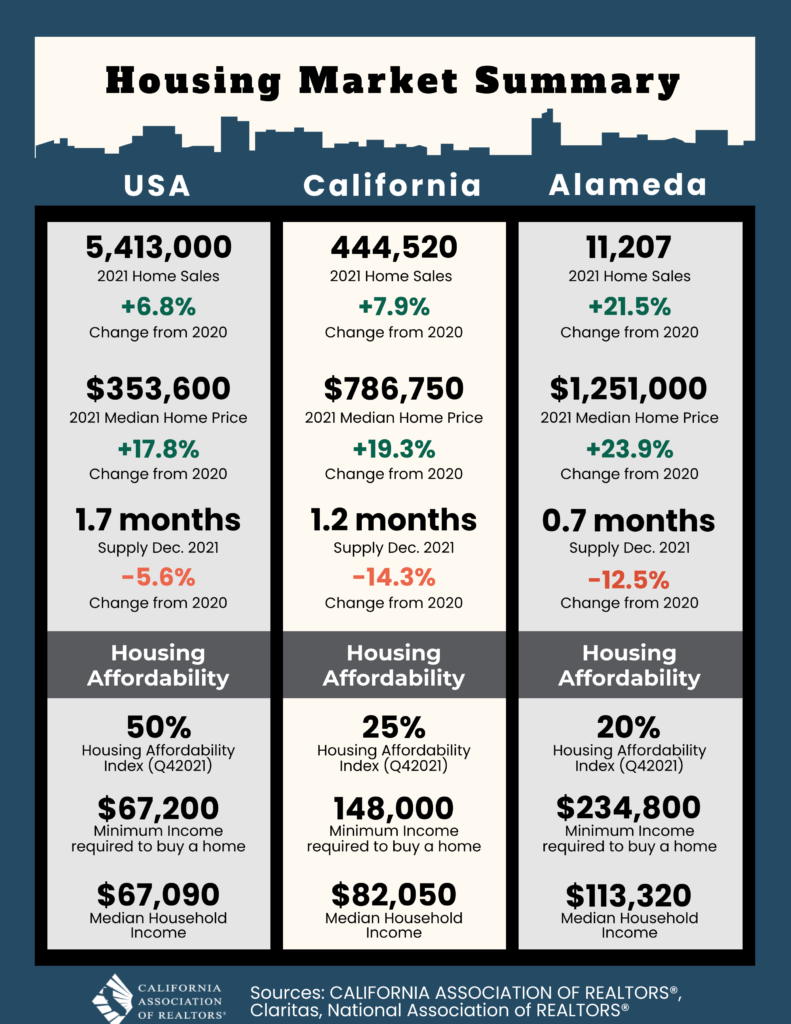

Homes in California are unaffordable according to new research out from the California Association of REALTORS®.

“The percentage of home buyers who could afford to purchase a median-priced, existing single-family home in California in first-quarter 2022 ticked down to 24 percent from 25 percent in the fourth quarter of 2021 and was down from 27 percent in the first quarter of 2021, according to C.A.R.’s Traditional Housing Affordability Index (HAI). The first-quarter 2022 figure is less than half of the affordability index peak of 56 percent in the first quarter of 2012.

C.A.R.’s HAI measures the percentage of all households that can afford to purchase a median-priced, single-family home in California. C.A.R. also reports affordability indices for regions and select counties within the state. The index is considered the most fundamental measure of housing well-being for home buyers in the state.”

The news is worse for those of us that live in the Bay Area.

“In the nine-county San Francisco Bay Area, affordability declined from the previous quarter in all counties. Alameda County was the least affordable Bay Area County, at just 17 percent of households able to purchase the $1,370,500 median-priced home. Thirty-seven percent of Solano County households could afford the $600,000 median-priced home, making it the most affordable Bay Area County.”

[ii] https://www.car.org/en/aboutus/mediacenter/newsreleases/2022releases/1qtr2022affordability

In the simplest terms the cost of housing has increased dramatically, while incomes have not. This is driving out government workers, teachers, nurses and other middle-income earners and pushing lower and low income folks into more dire circumstances up to and including homelessness.

Rays of Hope

All is not doom and gloom. In the past few years policy makers have realized that the current affordability crisis is impacting a wider range of people. They have created additional programs to assist with down payment and closing costs, which can not be covered by loans, and increased the AMI levels up to 120% which is traditionally considered working and middle class.

Both private and public institutions are working to build solutions that can address some of these issues. On the national level there is debate around forgiving student loan which collectively encompasses $1.75 trillion. California just unveiled the Forgivable Equity Builder Loan which offers an interest free second loan up to 10% of the purchase price of a home. Alameda County has the AC Boost program, which offers up to $210,000 to assist with the purchase of a home, and cities, such as Oakland and San Francisco also offer down payment assistance programs. These types of programs only happen with your support, so let your representatives know that these programs should be continuously funded.

Nonprofit entities are also coming with astoundingly creative models such as land lease for affordable housing development, buying co-operatives, land trust, and below market rate housing programs and additional financing assistance programs for out of pocket costs.

While it may feel daunting seeing all the obstacles that prevent home ownership, buying a home is still possible, and absolutely crucial for stabilizing and supporting our communities. We at Kees’ Realty are here to help you open the door to the home of your dreams.