It makes sense. You are young, your job does not pay enough, and you probably have a student loan payment or two that is eating into your check. Your old bedroom or the refurbished basement looks mighty good (and cheap) right now, and mom and dad respect you as the adult you are. Why not move back home?

According to a new study released by the Urban Institute, that choice could actually set you back and for far longer than what you may believe. “Young Adults Living in Parents’ Basements: Causes and Consequences”, tells that more young adults (25-34) are living with their parents and looks at both the reason behind the growing trend and the negative consequences of the decision.

“Young adults who stayed with their parents between ages 25 and 34 were less likely to form independent households and become homeowners 10 years later than those who made an earlier departure. Even if they did ultimately buy a home, young adults who stayed with their parents longer did not buy more expensive homes or have lower mortgage debts than did young adults who moved out earlier, suggesting that living with parents does not better position young adults for home ownership, a critical source of future wealth, and may have negative long-term consequences for independent household formation.”

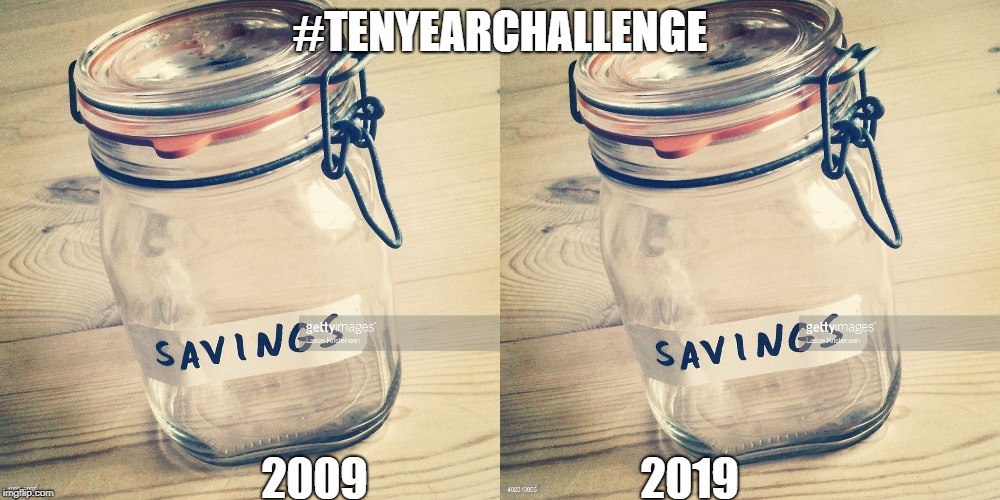

But there are valid reasons to stay at home and at least try to save right? Yes, two of the major factors cited as to why young people choose to stay at home are delay of marriage (which may be based on other factors such as employment status and high cost of living) and living in a high rent area, such as the Bay Area. However the paper concludes that when it comes to wealth building, a major benefit of home ownership, the earlier you can start the better. Putting off the long term gain for the short term benefit, no matter how practical it may seem, tends to end up putting young people behind financially. In another paper the authors find that those who bought homes between the ages of 25 and 34 have the greatest housing wealth at age 60 and that those who bought before age 25 receive the biggest housing investment return.

So how can you balance future long term benefit with the reality of living (and paying) in today’s world? Kees’ Realty can help you explore all your options and with some out of the box thinking like house hacking, co buying, and multifamily options, you may be out of mom and dad’s basement for good.